Venture Studio Winners - Feb. 2023

February was a strong month for venture studios and their startups

Welcome to Venture Studio Index - data and research on the venture studio industry. The free, public database of venture studios and their startups is here. Our list of every venture studio CEO role is here. If you aren’t subscribed, join the hundreds of studio executives, EIRs and future founders reading each week:

Key takeaways

February was a strong month for venture studios and their startups

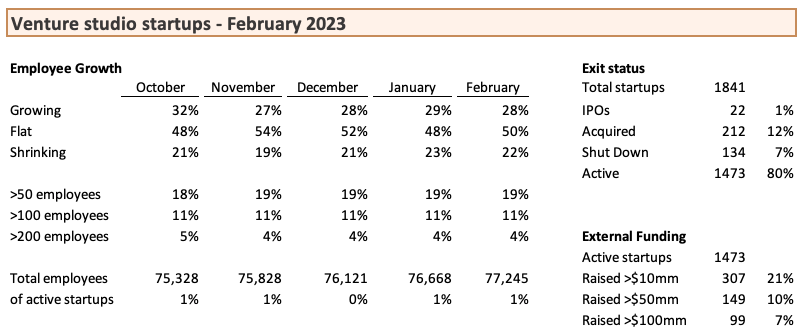

Headcount growth: headcount across all studio startups grew 1% in February, similar to January and faster than December

Funding: five major rounds, most notably Cyberstarts startup Wiz raising at a $10b valuation

Lightspeed Venture Partners led rounds in two different studio startups

Exits: five studio startups were acquired at small valuations or with terms not disclosed

Sector observations: most of the fastest growing startups were in Cybersecurity or Healthcare, both sectors that benefit from industry relationships and are hard for solo founders to enter

Studio batting %: at least 24 studios with the majority of their startups growing or having been acquired

Studio slugging %: 13 studios have launched multiple large winners (500+ employees or an IPO). These studios mostly do external investments as well as incubations and all manage large funds

Studio startup summary metrics

The fastest growing studio startups

Venture studios: top batting percentage

Venture studios: top slugging percentage

Studio startup funding

Cyberstarts startup Wiz, which provides cloud security design software, raised $300mm at a $10b valuation. The round was led by Lightspeed Venture Partners, Greenoaks Capital and Index Ventures (Pitchbook)

Greylock startup Tome, an AI-powered Powerpoint killer, raised $43mm at a $300mm valuation. The round was led by Lightspeed Venture Partners (Tome by Lightspeed)

Otherlab startup Gradient, which provides a heating and AC window unit, raised $18mm. The round was led by Sustainable Future Ventures and Ajax Strategies (Press Release)

Madrona Venture Labs startup Vouched, which provides identity verification for regulated industries, raised $6.3mm. The round was led by BHG VC and SpringRock Ventures (GeekWire)

High Alpha startup Zylo, a SaaS spend management tool, raised $5mm. The round was led by MassMutual Ventures (Press Release)

Studio startup exits

Foundry.ai startup Curia.ai, which provides AI software for value-based-care healthcare providers, was acquired by Aledade. Terms were not disclosed (MedCity News)

eMotion Studios startup Hitbel, a Brazil based software provider to churches, was acquired by One Big Media for R$20mm - approx USD $3.8mm (Crunchbase)

R/GA IoT Venture Studio startup Homebox, a UK based utilities comparison and switching service, was acquired by Billing Better. Terms were not disclosed (Finextra)

Rocket Internet startup Katoo, a Spain based software tool for restaurant suppliers, was acquired by Choco. Terms were not disclosed (Crunchbase)

Signal Ventures startup OilX, a UK based energy analytics provider, was acquiredd by Energy Aspects. Terms were not disclosed (Press Release)

Methodology and data limitations

Startup and studio data comes from our database of venture studios and their startups. See data methodology and limitations for more background.

In this analysis we use employee counts as a proxy for traction, but this is an imperfect metric. Some startups accelerate hiring ahead of revenue and other startups may be growing revenue quickly but have not accelerated their hiring. More recently, it’s common for even high performing startups to limit hiring or reduce headcount to prepare for future macro conditions.

Not all funding or acquisitions are announced, and those cases will be undercounted in the summary metrics above.

The table of fastest growing startups includes U.S. based startups launched since 2020. In the ventures studio table, We measure startups / year or startup velocity by taking the number of startups launched since 2017 and dividing by 5. This figure undercounts studios who do not disclose all their startups.