Venture Studio Winners - Mar. 2023

March was another strong month for venture studio startups across employee growth, funding and exits

Welcome to Venture Studio Index - data and research on the venture studio industry. The free, public database of venture studios and their startups is here. Our list of every venture studio CEO role is here. If you aren’t subscribed, join 1,205 studio executives, EIRs and future founders reading each week:

Key takeaways

March was another strong month for venture studios and their startups

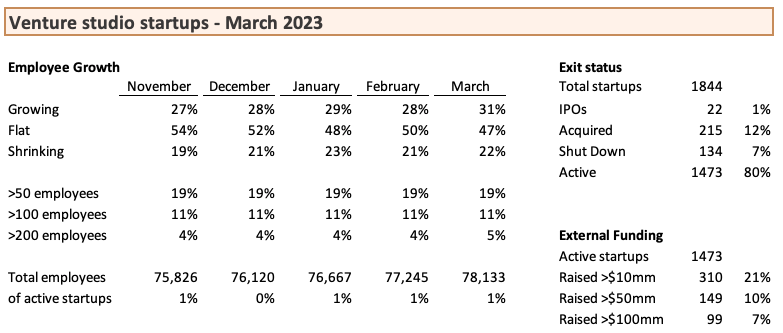

Total employees across all studios startup grew 1%, similar to prior months

Cyberstarts exited its startup Axis for “about $500m”

Eight funding rounds of greater than $5mm, the most in recent history

Layoffs also increased in March with 22% of startups losing headcount, +1pp from February

The fastest growing new startups were launched by either (a) well funded studios focusing on a specific end market like biotech, cyber, fintech or healthcare; or (b) incubated within a large vc like 8VC, Greylock, Sutter Hill or Thrive

Two of the fastest growing startups are rollups:

Intrinsic Brands, a women’s health products rollup by Redesign

Kite, a consumer goods rollup by Juxtapose (announced $200mm funding from Blackstone in April)

Studio startup summary metrics

The fastest growing studio startups

Venture studios: top batting percentage

Venture studios: top slugging percentage

Studio startup funding

8VC startup Resilience, a sustainable pharmaceutical manufacturing company, raised $400mm in federal funding (Endpoints News)

Flagship Pioneering startup Ring, an anellovirus therapeutics company, raised $86.5mm from Alexandria Venture Investments, Altitude Life Science Ventures and CJ Investment (VC News Daily)

Sutter Hill startup Ghost Autonomy, which produces self driving software, raised $45mm (Crunchbase)

Diagram Ventures startup Synctera, which provides fintech infrastructure for startups, raised $15mm. The round was led by National Bank of Canada, a strategic partner (Global Fintech Series)

Hypothesis Studio startup Starfish Space, which manufacturers satellite service vehicles, raised $14mm. The round was led by Munich Re Ventures (Techcrunch)

Post Urban startup Hazy, a synthetic data company, raised $9mm. The round was led by Conviction VC (London Tech Watch)

Atomic startup Playbook, a Gen-Z/millennial focused financial and tax management app, raised $7mm. The round was led by Telstra Ventures (FinSMEs)

Operate Studio startup Torpago, a corporate credit card platform, raised $4mm (Crunchbase)

Studio startup exits

Cyberstarts startup Axis, a cloud security company, was acquired by HP Enterprise for approximately $500mm (Globes)

TandemLaunch startup Algolux, a computer vision company, was acquired by Torc Robotics. Terms were not disclosed (Crunchbase)

Methodology and data limitations

Startup and studio data comes from our database of venture studios and their startups. See data methodology and limitations for more background.

In this analysis we use employee counts as a proxy for traction, but this is an imperfect metric. Some startups accelerate hiring ahead of revenue and other startups may be growing revenue quickly but have not accelerated their hiring. More recently, it’s common for even high performing startups to limit hiring or reduce headcount to prepare for future macro conditions.

Not all funding or acquisitions are announced, and those cases will be undercounted in the summary metrics above.

The table of fastest growing startups includes U.S. based startups launched since 2020. In the ventures studio table, We measure startups / year or startup velocity by taking the number of startups launched since 2017 and dividing by 5. This figure undercounts studios who do not disclose all their startups.