Venture Studio Winners - October 2022

October was a strong month for venture studios and their startups

Welcome to Venture Studio Index - data and research on the venture studio industry. The free, public database of venture studios and their startups is here. If you aren’t subscribed, join the hundreds of studio executives, EIRs and future founders reading each week:

Key takeaways

October was a stronger funding month than September

Across 1,767 studio startups we track in our database, new funding was >$500mm in October vs ~$150mm in September

Investors leading these rounds were Citadel, Left Lane Capital, MaC Venture Capital, Norwest Venture Partners, Primary, Tritium Partners, TTV Capital, and VI Partners

Note: we are considering developing a service that tracks (i) VCs who have backed venture studio startups, (ii) LPs who have invested in venture studios and (iii) early stage VC funds and their thesis areas. Contact data@venturestudioindex.com or reply to this email if interested

No major exits in October

Team Launch, WattX and Wright studios sold startups last month

Terms were not disclosed

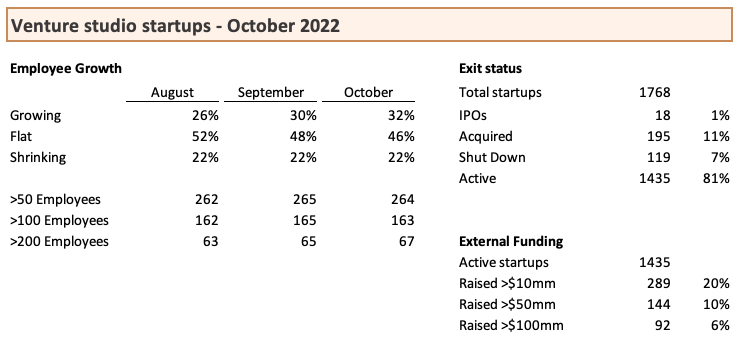

Headcount growth across all studio startups was +1% in October, similar to September and August

32% of active studio startups added employees last month, up from September and August

Popular themes for studio startups raising money or growing headcount were: agtech, AI, consumer fintech, cloud/data, electric vehicles, healthcare, labor marketplaces and proptech

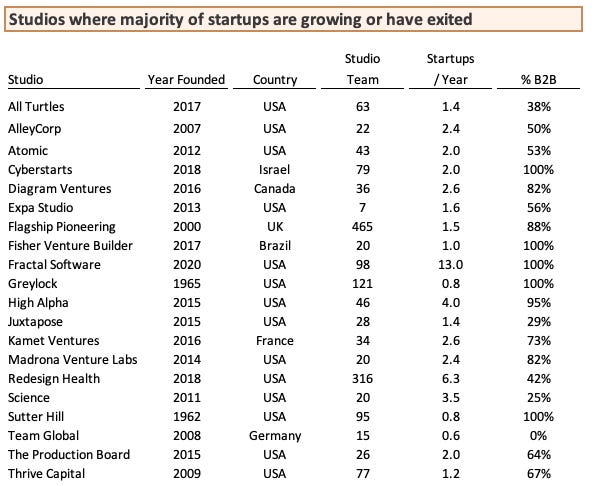

At least 20 studios demonstrated a high “hitrate,” with >50% of their startups either growing or having exited. These studios span multiple strategies, geographies and end markets

Fastest growing studio startups

Studio startup summary metrics

Studio startup exits

WattX startup Statice AI, a Berlin based data privacy startup, was acquired by Anonos. Terms were not disclosed (Press Release)

Team Launch startup Follain, a beauty retailer, was acquired by Credo. Terms were not disclosed (Bizjournals - $)

Wright Partners startup Comeby, a Kuala Lumpur based retail analytics SaaS tool, was acquired by Maxis. Terms were not disclosed (Digital News Asia)

For more detail, see: the largest all time venture studio startup exits.

Studio startup fundraises

Team Global startup Volocopter, which is developing eco-friendly air taxis in Germany, raised $175mm from the Saudi government (Press Release)

Kairos startup Bilt, a rewards app for renters, raised $150mm at a $1.5b valuation. Left Lane Capital led the round, with participation from Smash Capital, Wells Fargo, Greystar, Invitation Homes, Camber Creek, Fifth Wall, and Prosus Ventures (FinTech Global)

Sutter Hill startup Sila Nanotechnologies, which makes batteries for electric vehicles, received a $100mm grant from the US DoE (Crunchbase)

Coplex startup Qwick, a hospitality labor marketplace, raised $40mm. Tritium Partners led the round, with participation by current investors Album VC, Kickstart, Desert Angels and Revolution’s Rise of the Rest Seed Fund (Techcrunch)

Madrona Venture Labs startup Xembly, an AI meeting assistant, raised $15m. Norwest Venture Partners led the round, with participation from Lightspeed Venture Partners, Ascend, Seven Peaks Ventures, and Flex Capital (Geekwire)

Citi Ventures startup Onward, a fintech tool for co-parents, raised $10mm. TTV Capital led the round with participation from Lerer Hippeau, Citi Ventures, Correlation Ventures, and Gingerbread Capital (Press Release)

Atlanta Ventures startup Greenzie, which makes robotic lawnmowing software, raised $8mm as part of a strategic partnership with the Bobcat Company (Hypepotamus)

Diagram Ventures startup Retirable, a retirement planning service, raised $6mm. Primary led the round, with participation from Vestigo Ventures, Diagram, Portage and Primetime (Techcrunch)

Rocket Internet startup Flash Coffee, a Singapore based grab-and-go coffee chain, raised a $5mm extension from Citadel and Vulpes Ventures (Deal Street Asia)

Merantix startup Vara, which is developing automated medical radiology screening in Berlin, raised a €4.5M extension. VI Partners led the round, with participation from EQT Foundation, Med 360, AI Venture Studio, Merantix, as well as Think Health (FinSMEs)

BBVA Anthemis startup DwellWell, a homebuying guidance startup, raised $4.5mm from MaC Venture Capital (BuiltInLA)

Venture studios with highest hitrate (exits + growers)

Methodology and data limitations

Startup and studio data comes from our database of venture studios and their startups. See data methodology and limitations for more background.

In this analysis we used employee counts as a proxy for traction, but this is an imperfect metric. Some startups accelerate hiring ahead of revenue and other startups may be growing revenue quickly but have not accelerated their hiring. More recently, it’s common for even high performing startups to limit hiring or reduce headcount to prepare for future macro conditions.

Not all funding or acquisitions are announced, and those cases will be undercounted in the summary metrics above.

We measured startups / year or startup velocity by taking the number of startups launched since 2017 and dividing by 5. This figure undercounts studios who do not disclose all their startups.

Conclusion

The data from October compares favorably to September. While exits remained weak, funding was stronger as was the portion of startups adding headcount.

As mentioned in prior posts, the most optimistic metric is the 20+ studios who demonstrate a 50+% hitrate on their startups, which bodes well for their ability attract future founders and more LP capital. The fact that these studios operate across various geographies and end customer markets suggests there may be room for even more studios.

The successful firms above all have large in-house teams, which require a large operating budget and LP base. Several of these firms - such as Greylock, Sutter Hill and Thrive - are venture capital funds with an incubation arm. Since capital is an advantage in incubations and having proprietary access to deals is an advantage in raising capital, we may see more asset managers pursue incubations.